Beyond Backtest

Calculated,

Not Arbitrary

Algorithmic intelligence that evolves dynamically, not fixed to boundaries

Our Principles

Four principles that build systems to adapt, not break. Calculated decisions, zero assumptions.

69.9? Nothing

70.1? Everything

Your Entire Position, Decided by Just 0.2 Points

The Problem With Binary Logic.

Markets don't flip like switches. But traditional indicators do. One arbitrary number decides everything: buy or sell, enter or exit, safety or risk.

Fixed thresholds treat gradual market shifts as binary events. Real conditions evolve smoothly, but your signals jump from green to red at a single predetermined level.

No Thresholds

Computed

The Adaptive Approach

How Algionics Systems Work.

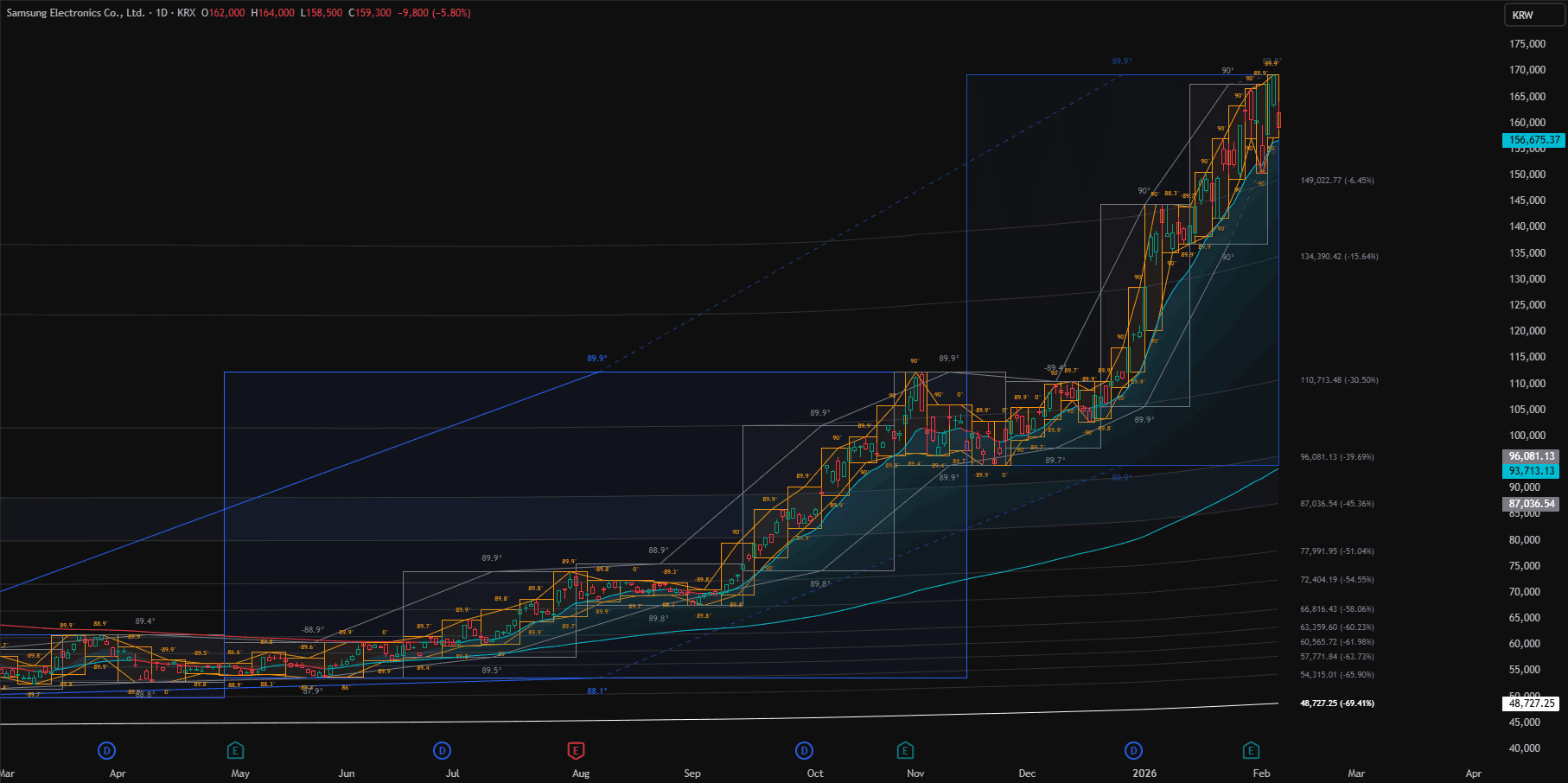

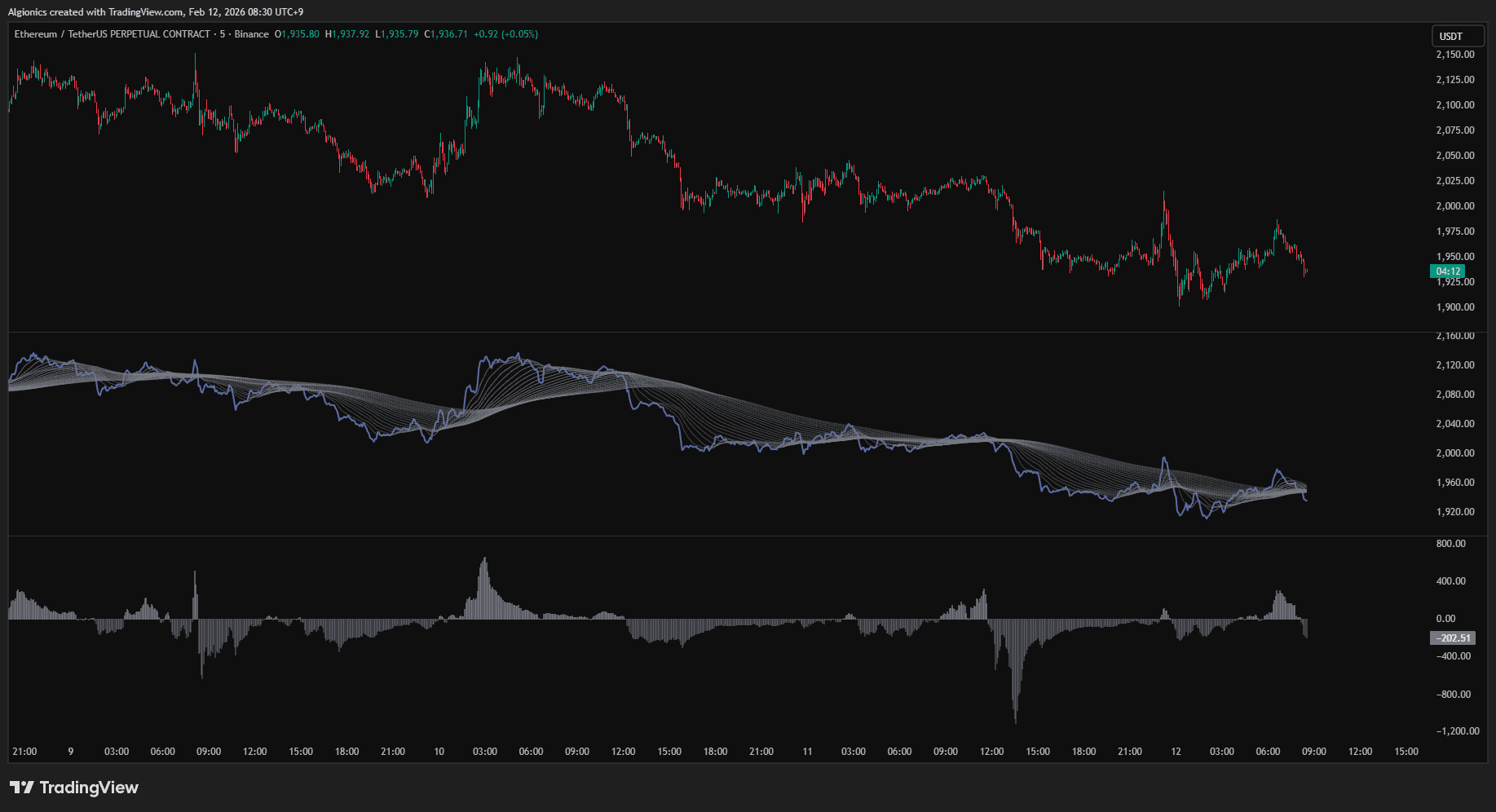

Markets don't respect arbitrary lines. Neither do our systems. We don't draw fixed boundaries and wait for price to cross them. We calculate market state in real-time, computing energy, density, momentum, and structure as conditions shift.

No 70/30 thresholds. No 2σ boundaries. Adaptive intelligence that responds to gradual change, not binary switches.

How We Compute Reality

The Technical Framework Behind Every Computation

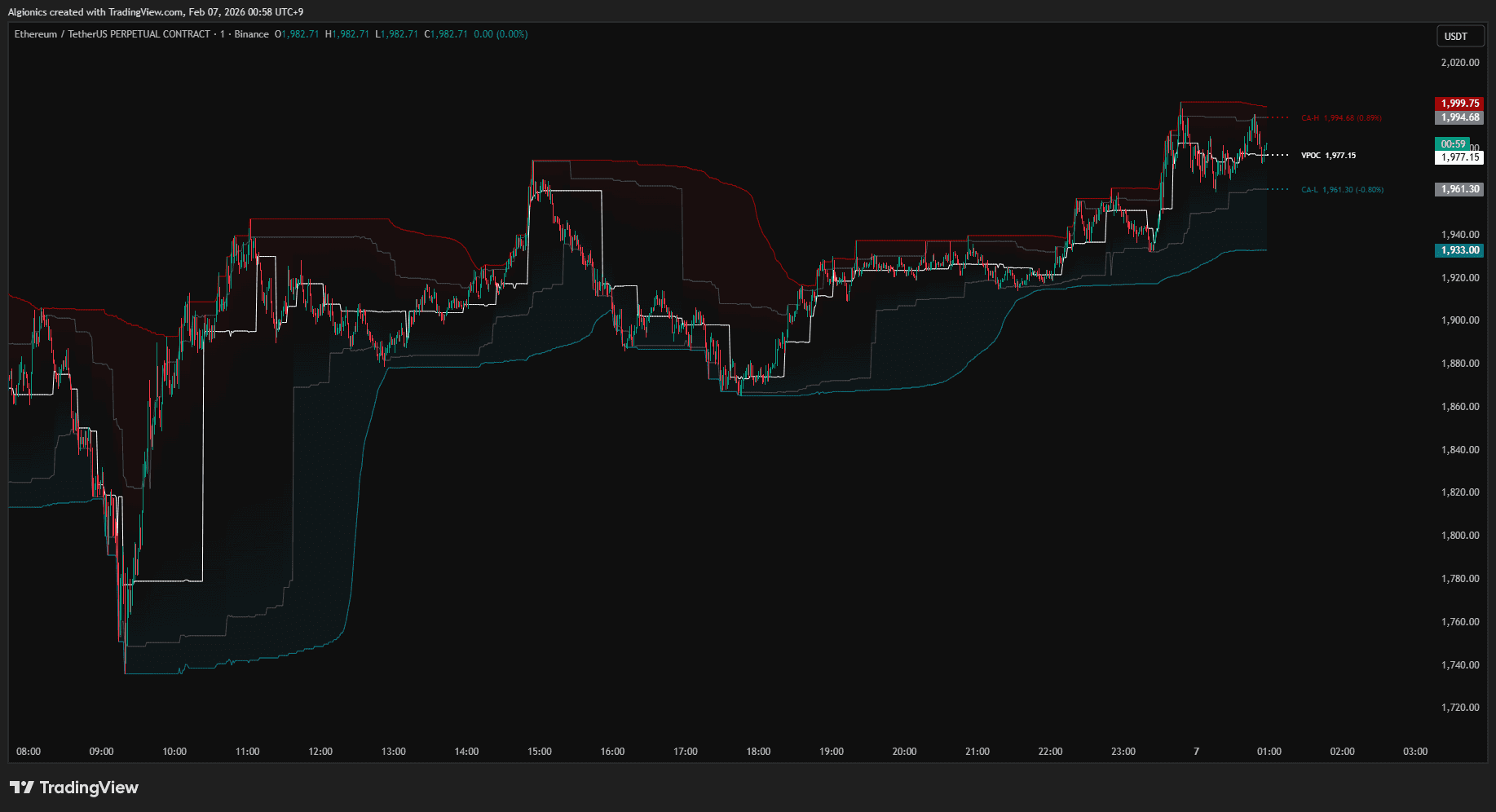

Signal Refinement

Gaussian Probability Filter

Probabilistic distribution filters high-frequency noise for total data continuity.

Advanced signal processing eliminates phase lag to extract refined market flow.

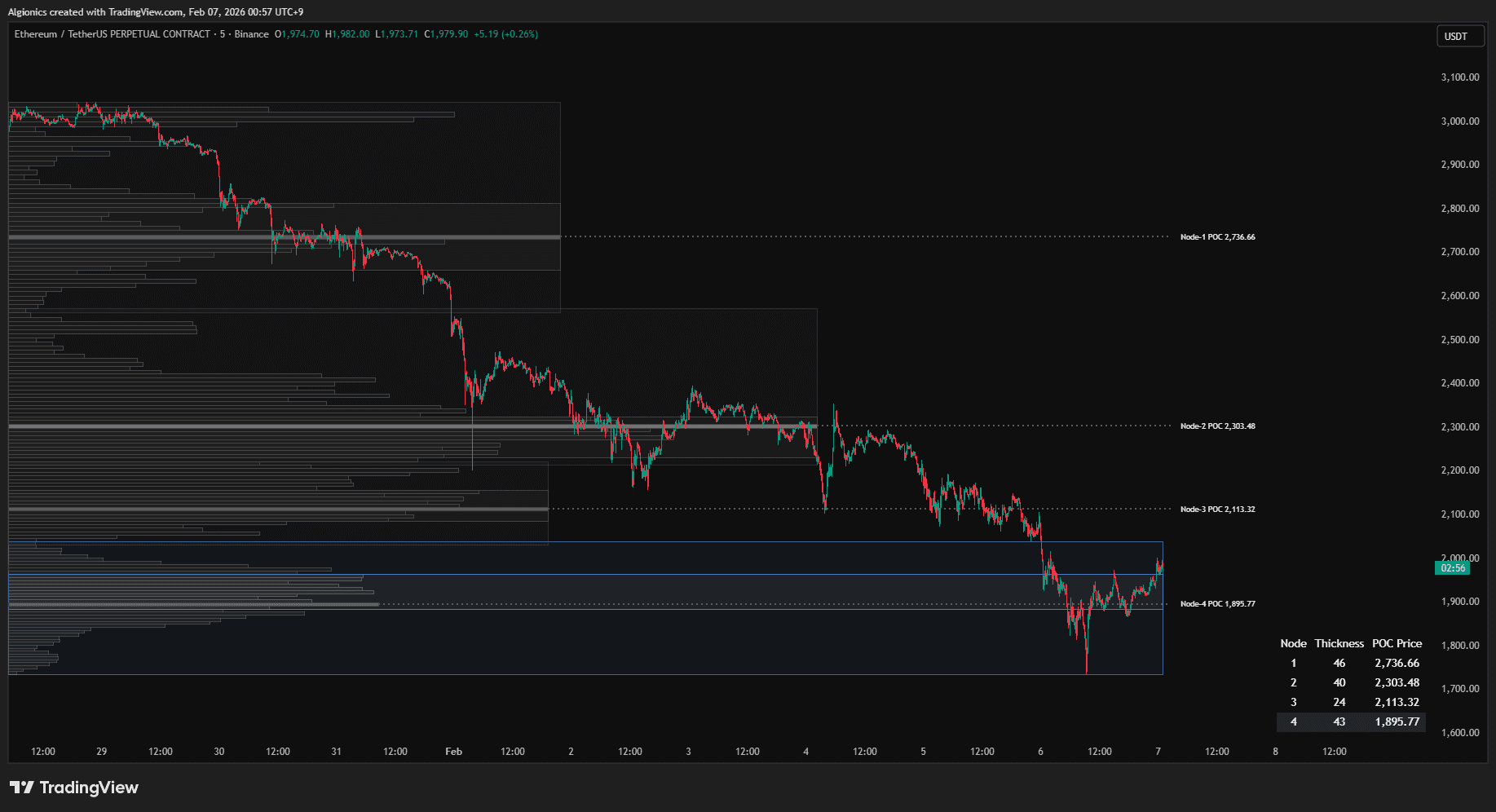

Kinetic Momentum

Newtonian Energy Dynamics

Price action is defined as motion within mass-bearing physical environments.

Computing acceleration and mass identifies the exact dissipation of market power.

Adaptive Integration

Z-Score Real-time Scaling

Score normalization removes arbitrary levels to interpret current market states.

Dynamic reference points scale with volatility to eliminate fixed market limits.

Structural Audit

Thermodynamic Efficiency

Trend purity is verified by calculating displacement relative to market entropy.

Mathematical audits distinguish breakouts from deceptive market noise.

Products

Currently Available on TradingView

Others measure what price does. We compute why it moves.

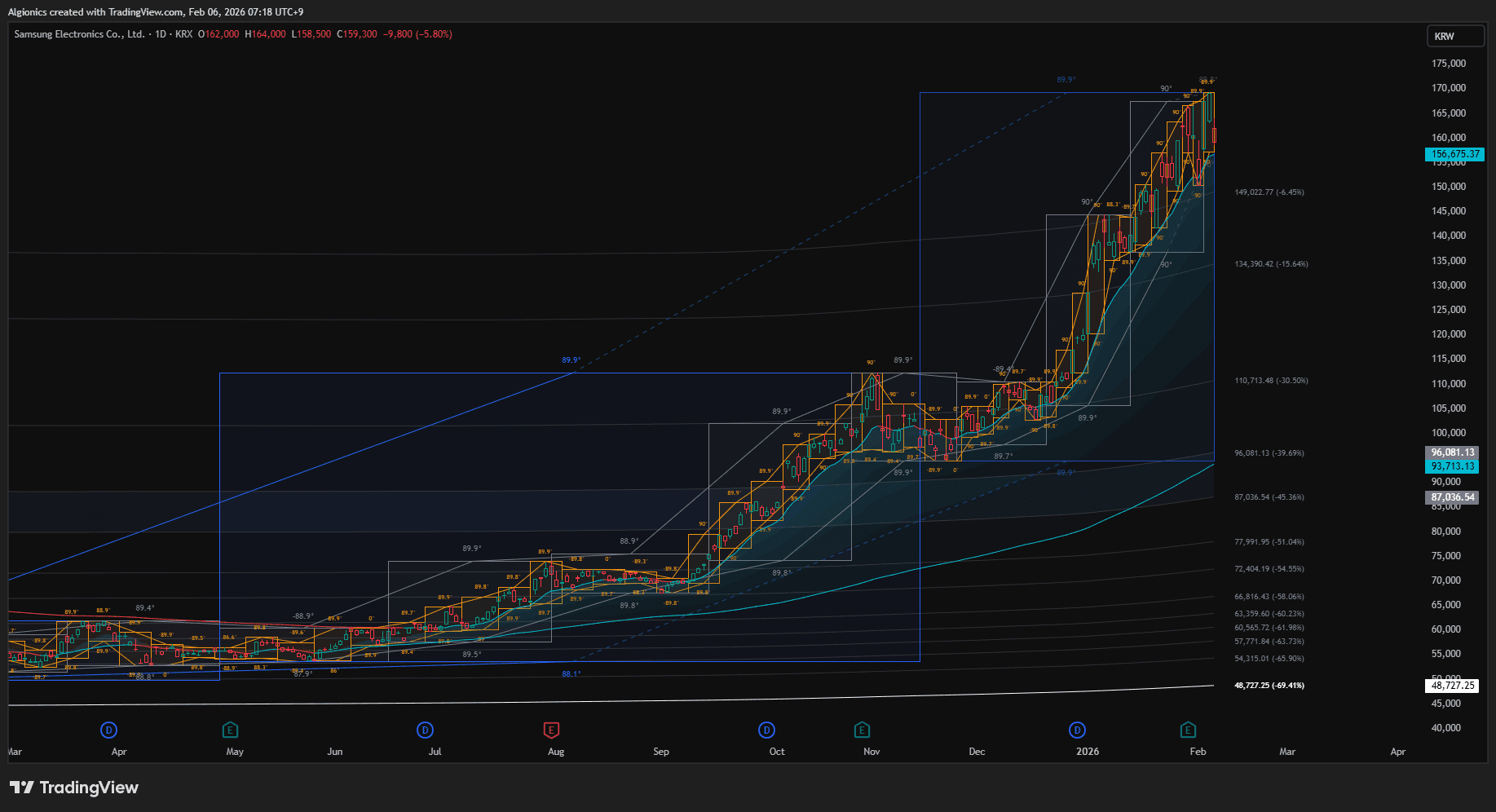

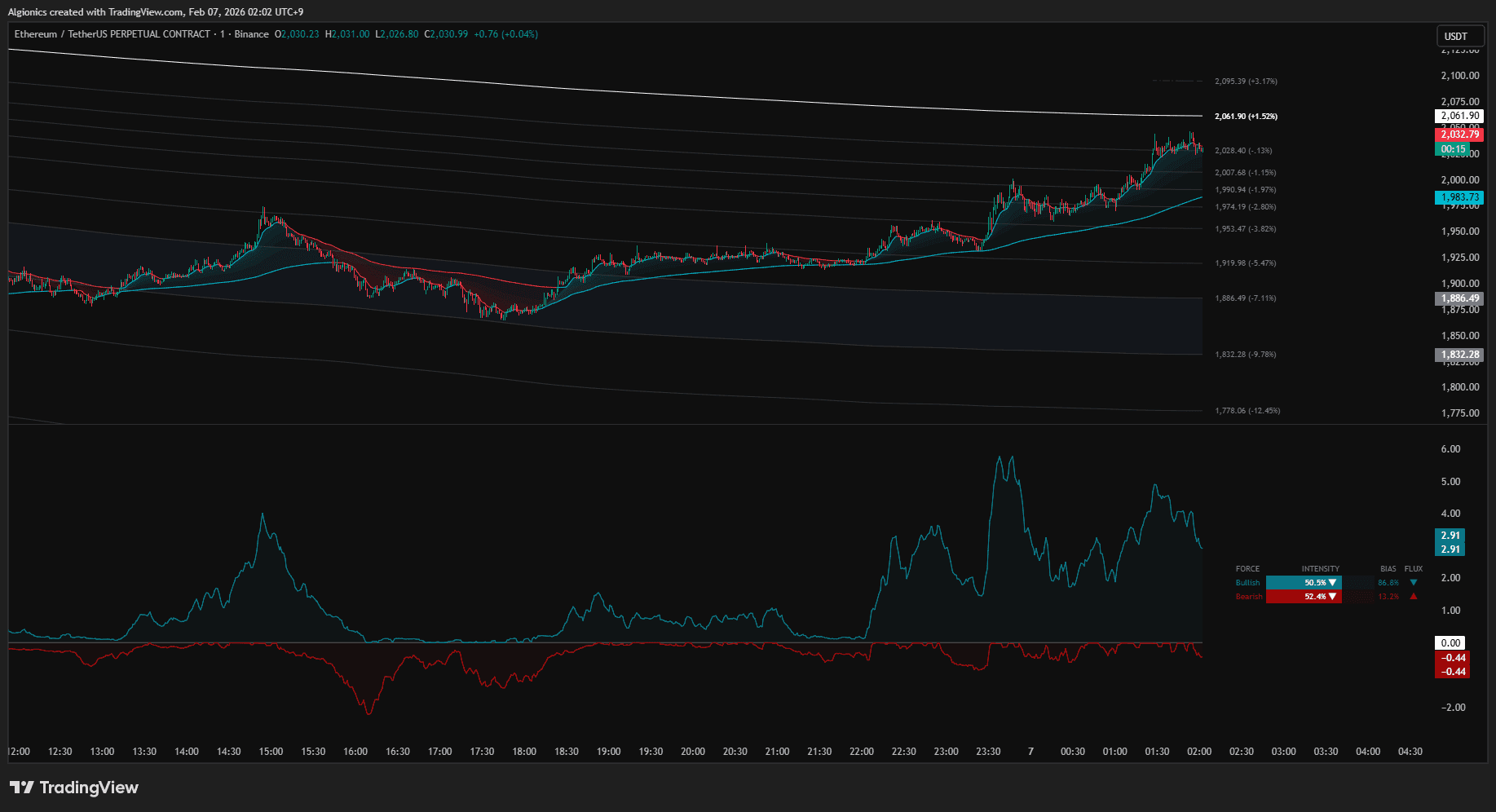

Professional Intelligence Built for Real Execution

Clear structure, adaptive analysis, execution ready decisions.

Institutional Grade Clarity

Interpret market conditions through evidence and constraints, verified by rigorous mathematical principles

Mathematical signals validate the market state in real time, reduce noise and bias, and prevent overreaction as conditions change.

Adaptive Market Response

Operate without constant monitoring or manual tuning, powered by a setup free architecture.

It adapts across assets and timeframes, monitors structural changes continuously, and alerts only when high confidence conditions align.

Execution Intelligence

Unify foundational components into a contextualized framework, presented as a single strategic view.

Clean outputs preserve context, clarify risk and timing, and support confident execution when volatility and complexity accelerate.

Have a trading concept that needs engineering?

We build custom indicators based on your strategy

Most platforms limit you to their preset tools. We don't.

If you have a trading idea, our engineering standards can transform it into a working Pine Script indicator. We handle both proven concepts and experimental approaches.

Clear logic. Clean code. Ready for your chart.

Bring your strategy to life.

Your Logic

Uncompromised

Most strategies don’t fail. They get simplified.

Technical limits. Tool constraints. AI that never quite does what you want. We don’t build around those compromises. We build what you actually intended.

TradingView

PINE SCRIPT V6

Custom Indicators & Strategy Scripts